san antonio local sales tax rate 2019

This includes the rates on the state county city and special levels. This is the total of state county and city sales tax rates.

Northwest Austin Residents To See Unprecedented Spikes In Home Valuations This April Community Impact

For tax rates in other cities see Florida sales taxes by city and county.

. Local Sales Tax Rate Information Report. The latest sales tax rate for San Antonio TX. Ad Find Out Sales Tax Rates For Free.

Sales Tax Rate Changes in Major Cities. The County sales tax rate is. Published on September 20 2019 by Youngers Creek.

Local Tax Rate a Combined Rate Combined Rank Max Local Tax Rate Alabama 400 40 514 914 5 700 Alaska 000 46 143 143 46 750 Arizona 560 28 277 837 11 560 Arkansas 650 9 293 943 3 5125 California b 725 1 131 856 9 250. State and Local Sales Tax Rates as of January 1 2019 State State Tax Rate Rank Avg. The Official Tax Rate.

San Antonio has parts of it located within Bexar County and Comal County. Did South Dakota v. Sales Tax Rate s c l sr.

Sales and Use Tax San Antonios current sales tax rate is 8250 and is distributed as follows. TX Sales Tax Rate. Every 2019 combined rates mentioned above are the results of Texas state rate 625 the county rate 0 to 05 the San Antonio tax rate 0 to 1375 and in some case special rate 05 to 2.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. Local Governments Eminent Domain. Texas Comptroller of Public Accounts.

The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division. 4 rows San Antonio TX Sales Tax Rate. Maintenance Operations MO and Debt Service.

City sales and use tax codes and rates. Wayfair Inc affect Texas. Next to city indicates incorporated city City Rate County Acampo 7750 San Joaquin Acton 9500 Los Angeles Adelaida 7250 San Luis Obispo.

The portion of the sales tax rate collected by San Antonio is 125 percent. The rates shown are for each jurisdiction and do not represent the total rate in the area. San Antonio collects the maximum legal local sales tax.

The Florida sales tax rate is currently. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. 0125 dedicated to the City of San Antonio Ready to Work Program.

The Texas sales tax rate is currently. This report shows jurisdictions adopting new or changed sales tax rates in the past 14 months. The five states with the highest average local sales tax rates are Alabama 514 percent Louisiana 500 percent Colorado 473 percent New York 449 percent and Oklahoma 442 percent.

County Sales Tax Rate. How is Sales Tax Calculated in San Antonio Texas. The San Antonio Texas sales tax is 625 the same as the Texas state sales tax.

The current total local sales tax rate in San Antonio TX is 8250. This is the total of state county and city sales tax rates. California City and County Sales and Use Tax Rates Rates Effective 07012019 through 12312019 1 P a g e Note.

Sales Tax in San Antonio Texas is calculated using the following formula. San Antonio TX Sales Tax Rate The current total. The current total local sales tax rate in San Antonio TX is 8250.

05 lower than the maximum sales tax in FL. Every 2019 combined rates mentioned above are the results of Texas state rate 625 the county rate 0 to 05. 1000 City of San Antonio.

The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio. Did South Dakota v. 1000 City of San Antonio.

The current total local sales tax rate in San Antonio FL is 7000. The minimum combined 2022 sales tax rate for San Antonio Florida is. Download and further analyze current and historic data using the Texas Open Data Center.

There is no applicable county tax. Twenty-five major cities saw an increase of 025 percentage points or more in their combined state and local sales tax rates over the past two years including 10 with increases in the first half of 2019. The San Antonio sales tax rate is.

The San Antonio sales tax rate is. The 7 sales tax rate in San Antonio consists of 6 Florida state sales tax and 1 Pasco County sales tax. This is the total of state county and city sales tax rates.

The minimum combined 2022 sales tax rate for San Antonio Texas is. The San Antonio Texas general sales tax rate is 625. While many other states allow counties and other localities to collect a local option sales tax Texas does not permit local sales taxes to be collected.

There is no applicable city tax or special tax. The current total local sales tax rate in San Antonio. San Antonio Local Sales Tax Rate.

There is no applicable county tax. The average cumulative sales tax rate in San Antonio Texas is 822. You can print a 7 sales tax table here.

The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio. Nineteen major cities now have combined rates of 9 percent or higher. 0125 dedicated to the City of San Antonio Pre-K 4 SA initiative.

0500 San Antonio MTA Metropolitan Transit Authority. Texas State Sales Tax Rate 625 c. Fast Easy Tax Solutions.

San Antonio has a higher sales tax than 100 of Texas other cities and counties. Average local rates rose the most in Florida jumping the state from the 28th highest combined rate to the 22nd highest. Bexar Co Es Dis No 12.

California City and County Sales and Use Tax Rates Rates Effective 0701. 0250 San Antonio ATD Advanced Transportation District. The County sales tax rate is.

Each tax year local government officials such as City Council Members School Board Members and Commissioners Court examine the taxing units needs for operating budgets and debt repayment in relation to the total taxable value of properties located in the jurisdiction. San Antonio FL Sales Tax Rate. Within San Antonio there are around 82 zip codes with the most populous zip code being 78245.

Wayfair Inc affect Florida. The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

2019 Official Tax Rates Exemptions.

Do My Property Taxes Increase If I Put A Cheap Mobile Home Or Rv On My Houston Texas Land Quora

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

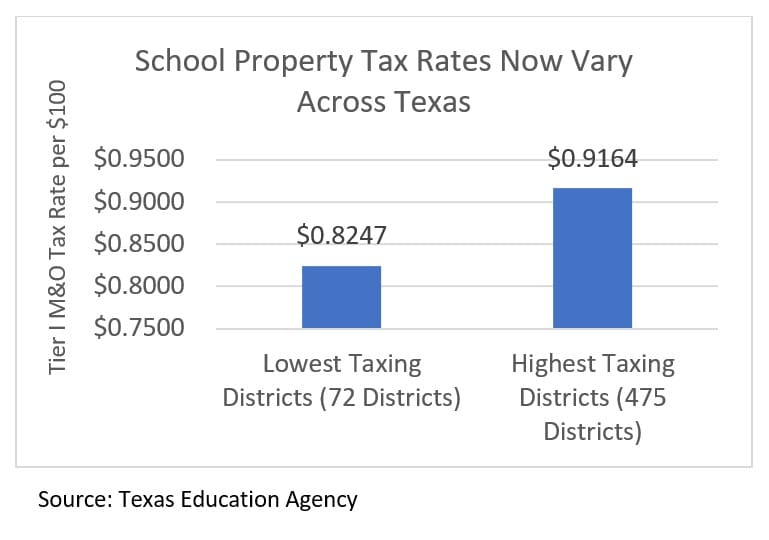

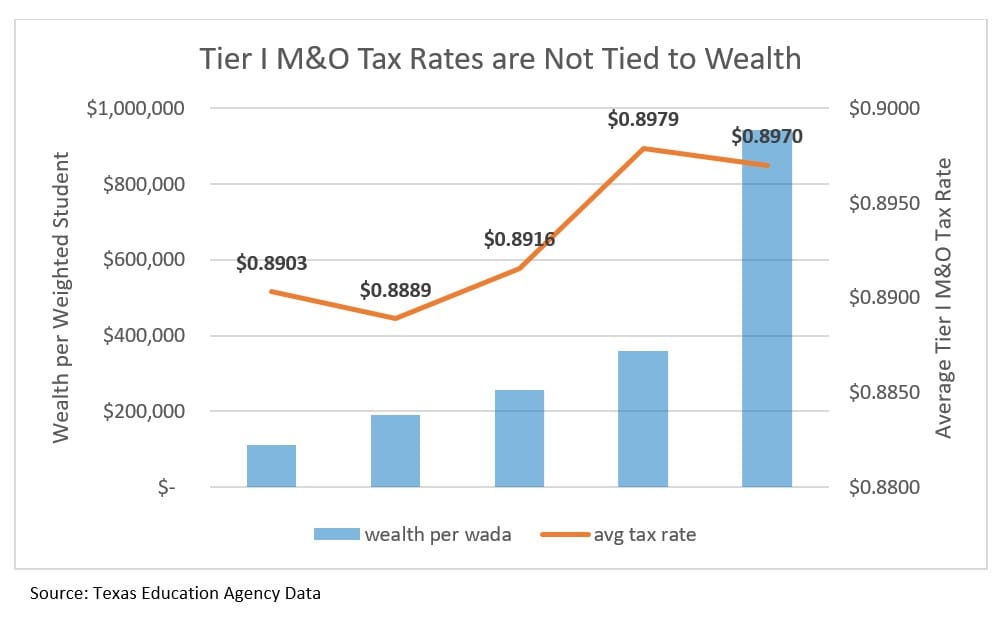

A New Division In School Finance Every Texan

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Massachusetts Property Taxes These Communities Have The Highest Rates In 2022 Boston Business Journal

San Antonio City Council Approves 10 Homestead Exemption

Texas Used Car Sales Tax And Fees

Why Are Texas Property Taxes So High Home Tax Solutions

Flower Mound Residents Likely To See Property Tax Rate Decrease For Upcoming Year Community Impact

Deductions For Sales Tax Turbotax Tax Tips Videos

A New Division In School Finance Every Texan

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Florida Sales Tax Rates By City County 2022

With Amazon S Support Texas May Collect New Online Sales Tax Austin Business Journal

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Tax Reform Faqs Top Questions About The New Tax Law Bdo

How To Calculate Sales Tax On Almost Anything You Buy

Study Despite Having No Income Tax Texas Has 11th Highest Tax Rate In The Country San Antonio News San Antonio San Antonio Current