can i gift more than the annual exclusion

So you can give each of your five grandchildren 15000 apiece in a given year for a total of 135000. You can give away this much in cash or property value without incurring a gift tax.

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

An annual exclusion gift falls within the limit and is tax-free.

. Caution on Using the Lifetime Exclusion. In this way how much can you gift someone in 2019. You can gift to as many people as you want.

That amount is called the annual exclusion. If someone gives you more than the annual gift tax exclusion amount 15000 in 2018 the giver must file a gift tax return. Even better if you contribute more than the 16000 annual exclusion amount to a 529 plan for any particular beneficiary you are allowed to spread as much as 80000 five times the annual exclusion amount over five years for gift-tax purposes.

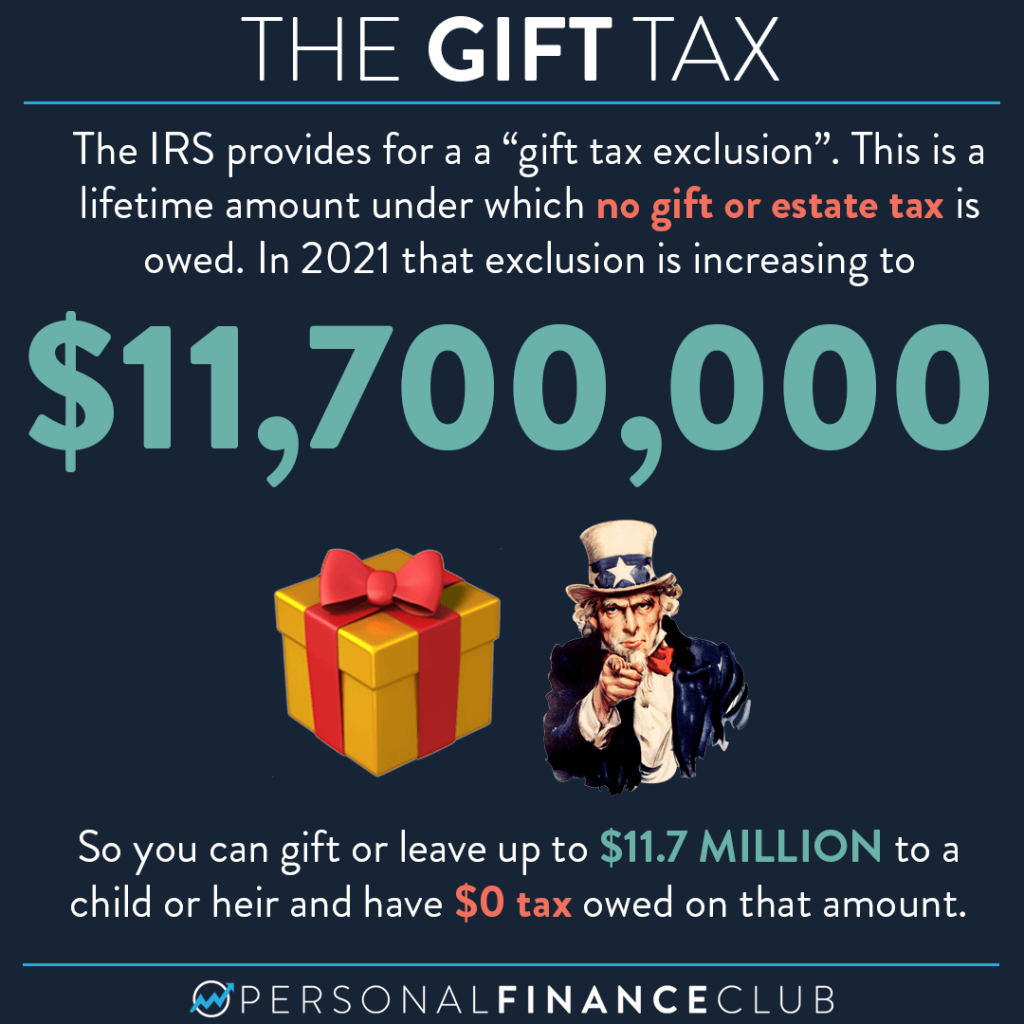

In 2022 the annual exclusion for Federal Gift Taxes increased to 16000 per person per year. However you dont actually have to pay gift tax unless the value of your lifetime taxable gifts has exceeded your lifetime exclusion. So if she makes taxable gifts exceeding the annual exclusion of 650000 this year she will owe no gift tax.

This technique allows one spouse to make gifts using both spouses annual exclusions for a total gift of 32000. The annual exclusion for 2014 2015 2016 and 2017 is 14000. You may also have.

The final and most significant nuance to the federal gift tax system is that every individual in the US. The annual gift tax exclusion provides tax shelter without eroding any part of the unified exemption. The gifts also reduce your taxable estate by 150000.

If giving above the annual exclusion amount is as. The annual gift tax exclusion is 15000 for the 2021 tax year and 16. The grantor will pay tax on the income of the trust but the appreciation of the asset is not included in the value of the gift and therefore does not use more than the.

The annual exclusion applies to gifts to each donee. If you gift more than the exclusion to a recipient you will need to file tax forms to disclose those gifts to the IRS. By 2022 it will increase to 16000 per recipient.

What is the gift tax on 50000. So if she makes taxable gifts exceeding the annual exclusion of 650000 this year she will owe no gift tax. Every year the IRS sets an amount of money that a gift-giver can give to a recipient free from taxes.

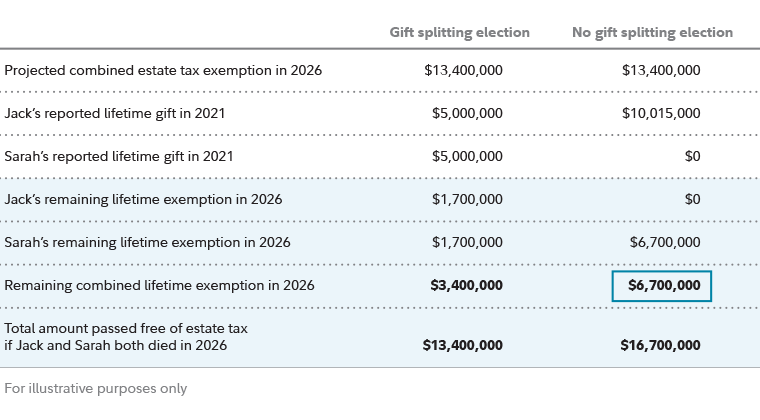

You can make individual 16000 gifts to as many people as you want. To qualify for gift splitting the spouses must file federal gift tax returns signed by both spouses consenting to the split even if a return would not otherwise be necessary were each to give 16000 individually. When you file a gift tax return the IRS will decrease your remaining lifetime exclusion amount by the.

In other words if you give each of your children 11000 in 2002-2005 12000 in 2006-2008 13000 in 2009-2012 and 14000 on or after January 1 2013 the annual exclusion applies to each gift. Contributions to 529 plans Coverdell ESAs and UGMA UTMAs are all treated as gifts subject to annual exclusion amounts. It is clear that if my client has never made gifts exceeding her annual exclusion her full applicable credit amount is available to her.

For 2018 2019 2020 and 2021 the annual exclusion is. This is the amount of money that you can give as a gift to one person in any given year without having to pay any gift tax. Married couples can double their tax-free giving to an individual by combining their limits.

The annual gift tax exclusion is 15000 as of 2021. There is even an advantage in her making gifts exceeding the applicable credit amount in that the gift tax on the gifts is also removed from. You just cannot gift any one recipient more than 16000 within one year.

In 2019 the annual exclusionary gift is 15000. The tax-free limit for 2021 is 15000 and 16000 for 2022. The 15000 annual exclusion means you can give 15000 to as many people as you want.

Spouses have an unlimited threshold of tax-free gift giving if the donee is a US. If youve got four nieces or nephews that you want to give 15000 each to this year for a total of 60000 then you can do so without facing any penalties. As we mentioned above the limit of 15000 applies on a per-recipient basis.

For 2021 the annual exclusion is 15000 per recipient. An annual exclusion gift is one that qualifies for the 15000 per person per year exclusion from federal gift taxes as of 2018 and 2019. If youre married you and your spouse can each gift up to 16000 to any one recipient.

If you give away up to but not more than 15000 per person in a calendar year whether in cash or other property of value then you definitely are not required to file a federal tax form known as a Form 709. Thanks to the annual gift tax exclusion in 2021 you can give each of these family members 15000 a total of 150000 without owing any gift tax. The IRS also confirmed that the annual gift exclusion amount for 2019.

If you give more than the annual exclusion amount you simply have to file a Gift Tax Return IRS Form 709. In 2018 the annual exclusion will be 15000 in 2017 it is 14000. Has a lifetime gift tax exclusion of 114 million indexed for inflation.

If youre married you and your spouse can each gift up to 15000 to any one recipient. The annual gift exclusion is the maximum amount you can give in any calendar year to an individual without needing to file a gift tax return. Although there is near-universal acceptance of the importance of gifting there are several issues you.

To maximize these tax benefits give 15000 to each recipient in December 2021 then give 16000 to each recipient in January 2022. Few spouses recognize that just as you can make annual trust gifts to other family members who are excluded from federal gift and estate tax you can also make annual tax-free gifts to your spouse. More than that amount you are expected technically to file a federal Form 709.

Under the annual exclusion you can give each recipient up to a limit each year with zero gift tax liability. You never have to pay taxes on gifts that are equal to or less than the annual exclusion limit.

Estate Planning Strategies For Gift Splitting Fidelity

How To Make The Most Of The Annual Gift Tax Exclusion Cpa Firm Tampa

How Does The Gift Tax Work Personal Finance Club

Avoid The Gift Tax Return Trap

Annual Gift Tax Exclusion Explained Pnc Insights

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

Annual Gift Tax Exclusion A Complete Guide To Gifting

Annual Gift Tax Exclusion A Complete Guide To Gifting

California Gift Taxes Explained Snyder Law

Estate And Gift Tax An Overview Findlaw

Gift Tax The Annual Exclusion And Estate Planning The American College Of Trust And Estate Counsel

Will You Owe A Gift Tax This Year

The Annual Gift Tax Exclusion H R Block

Annual Gift Tax And Estate Tax Exclusions Are Increasing In 2022

Annual Gift Tax Exclusion A Complete Guide To Gifting

How Can I Save On Taxes By Gifting Cash To Others

What Is The Gift Tax Exclusion For 2017 Cipparone Zaccaro

Gift Tax Return Lessons Common Mistakes And Tips For Your Gift Tax Return

/christmas-cash--wad-of-american-currency-tied-with-red-ribbon-611319628-ab2093a9addf4a46b6a54817e5eaee21.jpg)