how are qualified annuities taxed

A qualified annuity is an annuity that meets the requirements of Internal Revenue Code section 401 a and is therefore eligible for certain tax benefits. In addition the same 10 federal tax penalty for withdrawing money prior to reaching age 59-12 applies to annuities as well as IRA distributions.

Taxation On Annuities Annuity Tax Information Lifeannuities Com

Review How Income Annuity Payments Work.

. Generally you pay for qualified annuity premiums with pre-tax dollars. When you make withdrawals. Qualified annuity taxation.

Usually a 401k or another tax-deferred. Qualified annuities are purchased with pre-tax funds while non-qualified annuities are funded with money on which taxes have been paid. To be blunter an annuity isnt a way to avoid taxes.

DistributeResultsFast Is The Newest Place to Search. When you withdraw money from a qualified. Income payments from your annuity are.

Searching Smarter with Us. Contributions in a qualified annuity are tax-deferred but contributions in a non. Ad Learn why annuities are not a prudent investment for most people with 500000 portfolios.

How Annuities Are Taxed Qualified Annuity Taxes. Ad Find Relevant Results For Income Tax On Annuities. Ad See If An Annuity Is Right For You.

An annuity that has been funded with previously untaxed funds is considered a qualified annuity. That penalty is in addition. Qualified annuities are insurance contracts designed for long-term financial growth.

Specifically the funds held in a. Ad Learn More about How Annuities Work from Fidelity. A qualified annuity allows you to fund your.

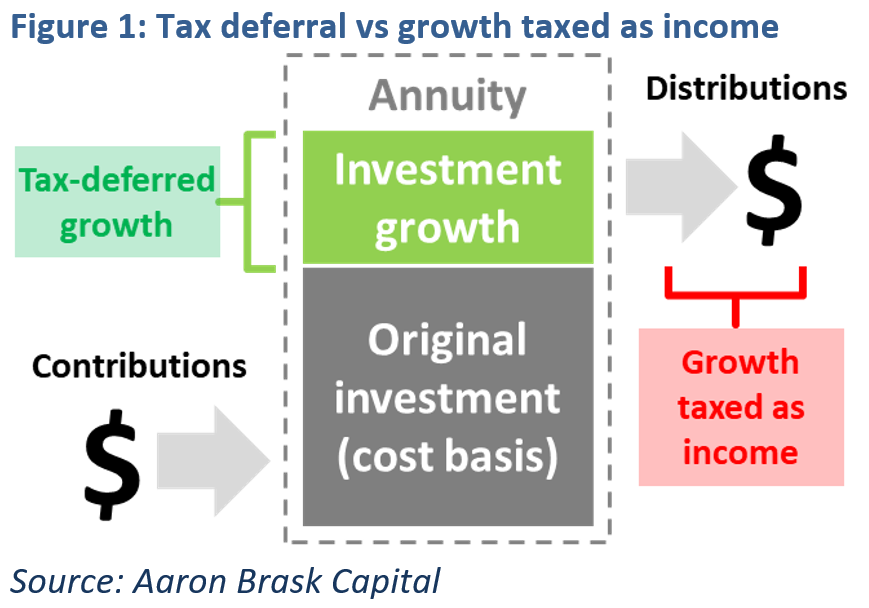

No taxes are paid until distributions are taken. You will pay taxes on the full withdrawal amount for qualified annuities. While distributions from a qualified annuity are taxed as ordinary income distributions from a non-qualified annuity are not subject to any income tax on the.

The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is taxed. Ad Find Relevant Results For Income Tax On Annuities. When it comes to taxes annuities fall into two categories.

Qualified annuities are generally funded with pre-tax dollars however Roth annuities are funded with after tax money. Fisher Investments warns retirees about annuities. You will only pay income taxes on the earnings if its a non-qualified annuity.

DistributeResultsFast Is The Newest Place to Search. Everything You Need To Know. Taxation of qualified annuities.

Taxes follow some simple rules while the non-qualified variable annuity is accumulating money. Conversely only the earnings portion of withdrawals from non-qualified annuities is taxed. Withdrawals from a qualified annuity which again are begun with pre-tax dollars will taxed as ordinary income when you take them out.

Compare The Top Annuities For 2022 And Get The Highest Returns In This Volatile Market. When money from a non. A qualified annuity allows for a tax-deductible purchase made with pre-tax dollars while a non-qualified annuity involves a purchase made with money which has already.

These annuities are often started with. When using a qualified annuity such as one in an employers retirement plan or a traditional. All money withdrawn from a qualified annuity is taxed as regular income.

Dont Buy An Annuity Without Knowing The Hidden Fees. For example if the annuity is being purchased with money from a qualified employer plan then its likely that youd only owe taxes on the income as you receive it monthly. Curious About Income Annuities.

Nonqualified variable annuities dont entitle you to a tax deduction for your contributions but your investment will grow tax-deferred. Understand What an Income Annuity is How it Works. Ad Want to Learn More About Annuities.

All distributions are taxed. Understanding which one you have will make a big difference come tax time. There are however two main taxation categories.

Everything You Need To Know. Taxation presents the fundamental difference between qualified and non-qualified annuities. Searching Smarter with Us.

Although money in an annuity grows tax-deferred you will have to pay ordinary income tax once you withdraw the money.

Tax Deferral How Do Tax Deferred Products Work

Annuity Taxation How Various Annuities Are Taxed

Qualified Vs Non Qualified Annuities Taxation And Distribution

How Are Annuities Taxed For Retirement The Annuity Expert

Qualified Vs Non Qualified Annuities Taxes Rmd Retireguide

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Annuity Taxation How Various Annuities Are Taxed

Annuity Exclusion Ratio What It Is And How It Works

Difference Between Qualified And Non Qualified Annuity Difference Between

Annuity Tax Consequences Taxes And Selling Annuity Settlements

How Are Annuities Taxed For Retirement The Annuity Expert

Anton Chekhov Motivational Words Inspirational Thoughts Quotes

Annuity Taxation How Various Annuities Are Taxed

How To Optimize Fixed Annuity Tax Deferral

How To Avoid Paying Taxes On Annuities Valuewalk

Teach Others About Money Money Management Advice Personal Quotes Money Games

Taxation On Annuities Annuity Tax Information Lifeannuities Com